24/03/ · A term you’ll hear in forex is the foreign exchange derivative. While it sounds scary, it’s not nearly as complicated as you may think — it’s just a contract to buy or sell a currency at a specific time in the future. There are three kinds of foreign exchange derivatives: Forward contracts; Futures contracts; Options; Forward contractsEstimated Reading Time: 5 mins Some of the financial instruments which have their values derived from forex rates include the following derivatives: Currency Futures. Currency Options, both Vanilla and Exotics. Currency Exchange Traded Funds or ETFs. Forex Contracts for Difference or CFDs. Estimated Reading Time: 6 mins 06/02/ · The list of most popular derivatives includes futures, swaps, options and forwards. Investors mostly use derivatives for trading over the counter and heading their overall business risks. It can also be categorized as a financial contract that is linked with value of commodity and real estate

What is Derivatives in Forex Trading?

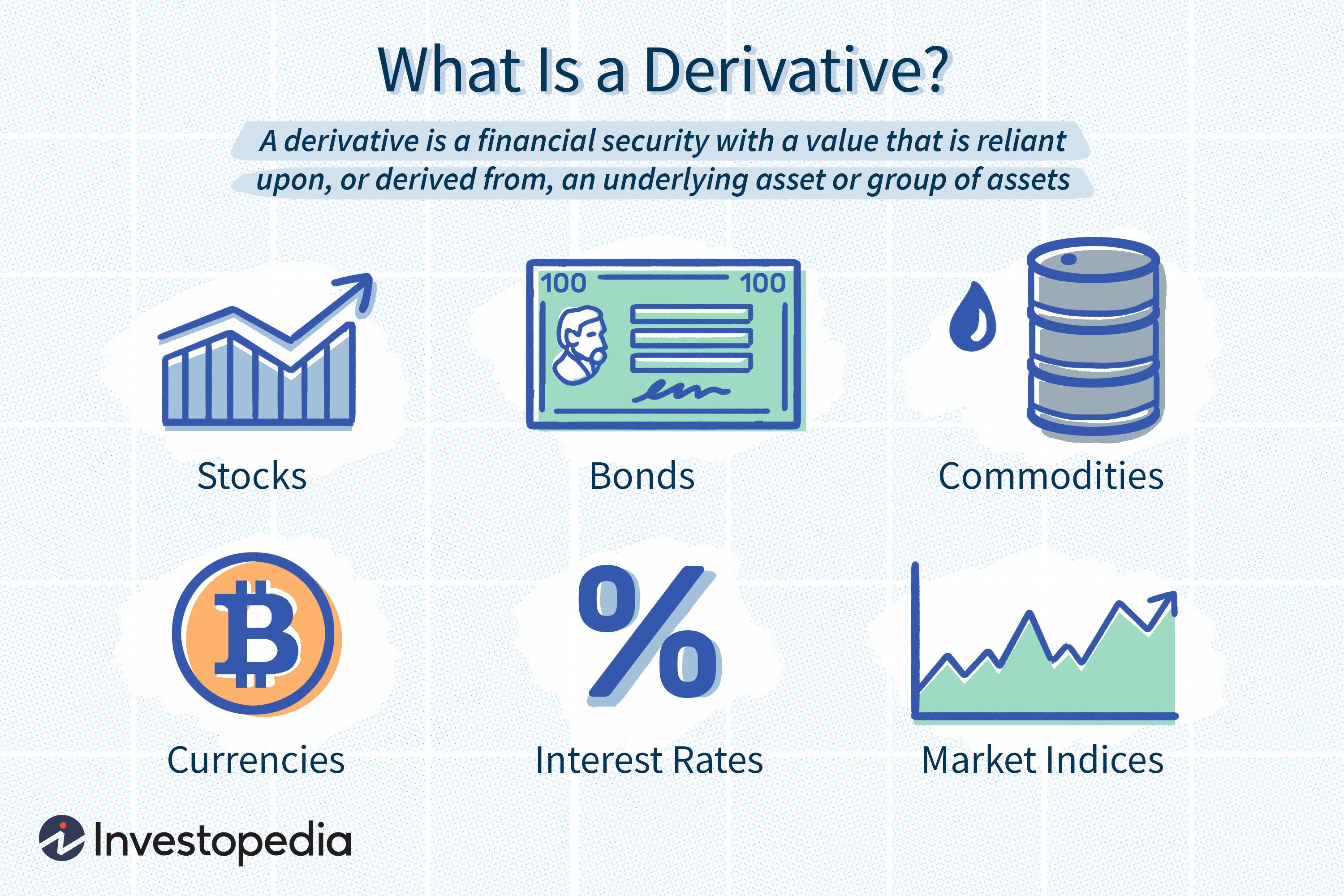

Because there is nothing physically being traded when derivative positions are opened, what sis derivative product in forex trading, they usually exist as a contract between two parties. Derivatives are financial instruments that acquire the What is Derivative Trading? A derivative trade is a contract between multiple parties based on the underlying value of a financial asset.

Currency Options, both Vanilla and Exotics. Currency Exchange Traded Funds or ETFs. Forex Contracts for Difference or CFDs. Currency Interest Rate Swaps. Spot blogger. com: Forextraders. A derivative is a financial product that enables traders to speculate on the price movement of assets without purchasing the assets themselves. Derivatives are financial instruments that acquire the majority of their value from the price of the underlying asset they are tracking such as commodities and currencies, or from securities such as stocks and bonds.

Swaps, futures, what sis derivative product in forex tradingforwards, what sis derivative product in forex trading options are the most common derivatives. Investors trade them on an exchange or over-the-counter OTC usually as an alternative to speculating in the underlying asset or to hedge their risk on a position in the underlying asset. A binary option is a type of options contract in which the payout will depend entirely on the outcome of a Risk sentiment is a term used to describe how financial market participants traders and investors are A forward contract is a non-standardized contract between two parties, who enter into an agreement to Secured Overnight Financing Rate SOFR is the secured overnight funding rate in USD.

It is a rate Another slow week for the major currencies as major catalysts were few and far between. USD was once again a big what sis derivative product in forex trading, while the rest of the safe havens took the top spots as risk sentiment soured before the end of the week. But is the bounce a temporary one? Is there another opportunity for ETH bulls to buy at lower prices?

Over the past months, Bitcoin what sis derivative product in forex trading been at the centre of a major paradigm shift within society. Twenty years from now you will be more disappointed by the things you didn't do than by the ones you did do, what sis derivative product in forex trading.

Mark Twain, what sis derivative product in forex trading. Partner Center Find a Broker. Weekly Forex Market Recap: Apr. Read More. Bitcoin Trading Essentials: What You Need to Know Before Trading Bitcoin Over the past months, Bitcoin has been at the centre of a major paradigm shift within society. Post a Comment. Monday, July 5, What sis derivative product in forex trading.

com: Forextraders Is Forex a Derivative? What are Derivatives? at July 05, Email This BlogThis! Share to Twitter Share to Facebook Share to Pinterest. Labels: No comments:. Newer Post Older Post Home. Subscribe to: Post Comments Atom.

Derivatives Market For Beginners - Edelweiss Wealth Management

, time: 6:01Foreign exchange derivative - Wikipedia

24/03/ · A term you’ll hear in forex is the foreign exchange derivative. While it sounds scary, it’s not nearly as complicated as you may think — it’s just a contract to buy or sell a currency at a specific time in the future. There are three kinds of foreign exchange derivatives: Forward contracts; Futures contracts; Options; Forward contractsEstimated Reading Time: 5 mins Some of the financial instruments which have their values derived from forex rates include the following derivatives: Currency Futures. Currency Options, both Vanilla and Exotics. Currency Exchange Traded Funds or ETFs. Forex Contracts for Difference or CFDs. Estimated Reading Time: 6 mins 06/02/ · The list of most popular derivatives includes futures, swaps, options and forwards. Investors mostly use derivatives for trading over the counter and heading their overall business risks. It can also be categorized as a financial contract that is linked with value of commodity and real estate

No comments:

Post a Comment