A very popular hedging method in binary options trading is “the straddle”. This strategy is not easy because it’s difficult to find the righ setups. It’s a strategy about two contracts with different strike price to the same asset. Let’s see a screen shot. This binary option chart is from GBPUSD currency pair. The general idea of this strategy is to create bounds for the same asset with two contracts/5(). In fact, some sharp traders use binary options for hedging profitable forex positions and for extending profitability in the case of small pullbacks. Hedging in this instance means using binary options in such a way that you come up with a way to lose only slightly while being open to higher gains. Hedging is a risk management technique that refers to mitigating, controlling, or limiting risks when trading binary options in different financial markets. Using the Binary Options Hedging Strategy, the trader would place both put and call options on the same asset, at the same time.

Hedging a Binary Option

Binary options are an interesting way to speculate on the markets. The idea that they pay all or nothing, regardless of how far the price moves, makes it easier to understand, but also more akin to gambling on the outcome, in this case the price at expiration. But what some don't realise is that you can also use binary options for hedging as well as speculation. In hedging forex with binary options, some sharp traders use binary options for hedging profitable forex positions and for extending profitability in the case of small pullbacks.

Hedging in this instance means using binary options in such a way that you come up with a way to lose only slightly while being open to higher gains. Binary options have a strike price and expiration period, which may be as little as a few minutes or hours. If the hedging forex with binary options is above the strike price at expiration, a binary call option pays out the set amount; a put option would pay nothing.

If the actual price is below the strike price at expiration, the binary call option is worthless, but a binary put option would pay out the agreed amount.

The price of the option depends on how likely the outcome is, including how far in or out of the money the underlying is trading at present. Hedging a binary option involves buying both a put and a call on the same financial instrument, with strike prices that allow both to be in the money at the same time.

That is, the strike price of the binary call option is lower than the strike price of the binary put option. Consider what this means.

If the actual price is between the two strike prices at expiration, both the put and the call option would be in the money, and you would make a healthy profit over your premium outlaid.

This is the best scenario, and all it requires is for the price to be in a range, the size of which is up to you. Admittedly, the larger the range, the more the binary options will have cost you, but that is part of your assessment on making the trade. But because you have hedged your trade by taking both sides, hedging forex with binary options, with the call and the put, hedging forex with binary options, even if the price goes outside the range, all is not lost, hedging forex with binary options.

Taking a single binary option would mean losing it all if it finished out of the money; but with this method, one of the options will still pay out regardless, cushioning the loss.

You will still take a loss, as the premiums will be more than the payout of one single option, but the loss will be much less than it could have been.

In summary, to hedge with binary options, you buy a binary call option and a binary put option, with strike prices that overlap, so that at least one of them will pay out.

You can win a greater amount than by taking just one option, and if you lose money you will lose far less than the straight loss that you would suffer with just one option, hedging forex with binary options.

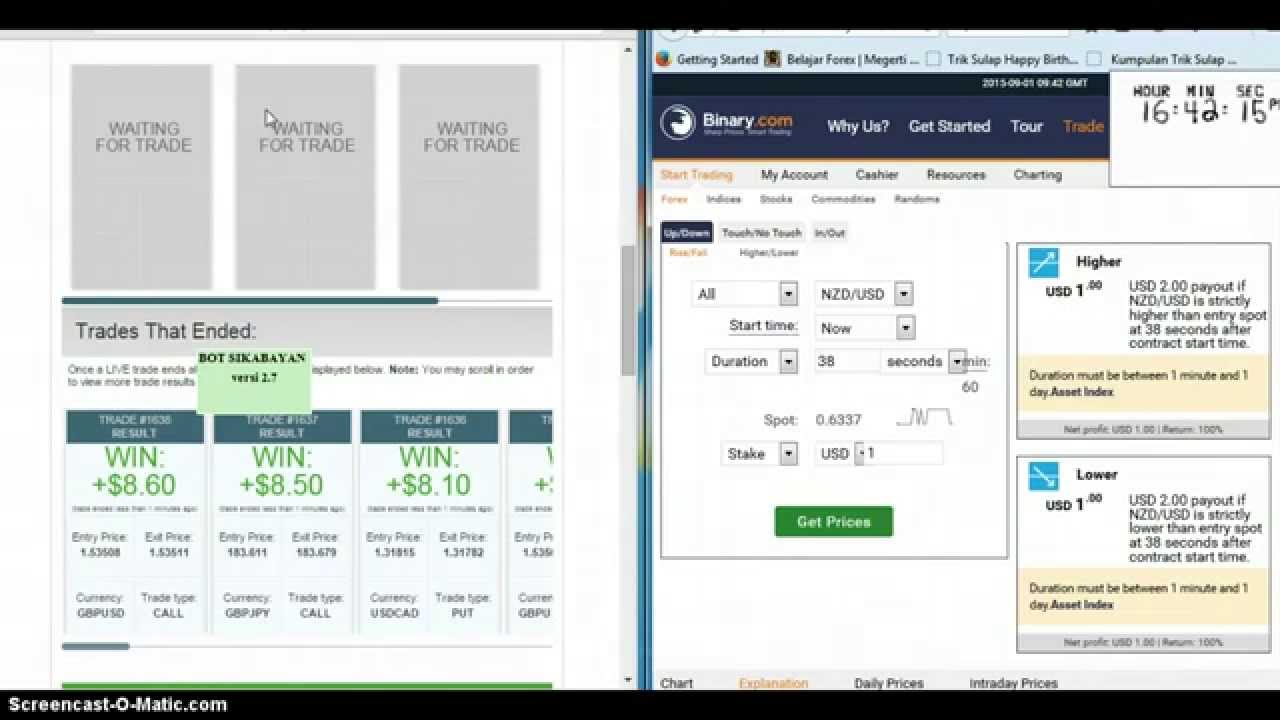

Here's a real-life example of a binary option hedge as highlighted on MarketsPulse. The scenario takes the case of a forex binary option on the price of the Euro. In this instance the Euro has been rising and is predicted to keep on rallying at a determined breakout point. At this level you would place a call, expecting the Euro to keep on rising. But what if the price changes direction and falls rapidly? You can place a put option at another point, helping you to minimize risk in the event that the price does indeed retrace.

In each case, you stand a possibility of gaining a bigger profit by hedging, or placing two bets in opposite directions, as opposed to an all-or-nothing outcomes of one binary bet. In the instances in hedging forex with binary options you stand you lose money, you lose far less than the possibility you have to gain a greater profit hedging forex with binary options loss in other circumstances.

Become a fan on Facebook Follow us on Twitter. Go back to Fixed Odds Financial Betting.

Hedging Trades Using Binary Options

, time: 5:09Hedging with Binary Options - Simple Risk Management

Hedging is a risk management technique that refers to mitigating, controlling, or limiting risks when trading binary options in different financial markets. Using the Binary Options Hedging Strategy, the trader would place both put and call options on the same asset, at the same time. If you are wrong with your binary options trade, you only lose the $, which is the equivalent of 10 pips on the spot Forex market. Of course, if your binary options trade is wrong, and EUR/USD rises as you expected, you come out ahead. If EUR/USD gains 30 pips, you have a net profit of $ once you factor in the cost of your binary options. In fact, some sharp traders use binary options for hedging profitable forex positions and for extending profitability in the case of small pullbacks. Hedging in this instance means using binary options in such a way that you come up with a way to lose only slightly while being open to higher gains.

No comments:

Post a Comment