Nov 27, · Sometimes an online option calculator isn’t enough and you’d like to implement the Black & Scholes (B&S) option pricing equations in Excel. If you’re just playing around it doesn’t matter how you structure the calculation. In fact, for clarity’s sake, it’s probably a good idea to spread out the calculation across multiple cells. Jan 23, · N (d) = 1 2 π ∫ − ∞ d e − 1 2 x 2 d x. C (S, t) is the value at time t of a call option and P (S, t) is the value at time t of a put option. The Black-Scholes call formula is given as: C (S, t) = S N (d 1) − K e − r (T − t) N (d 2) The put formula is given. Dec 14, · A black scholes formula binary option excel South Africa trader needs to consider a range of things when selecting a genuine premier broker to join. First off, you'll want to create how to get bitcoin without investment India a trade on Paxful.

Black-Scholes pricing of binary options - Quantitative Finance Stack Exchange

Since being published, the model has become a widely used tool by investors and is still regarded as one of the best ways to determine fair prices of options. The purpose of the model is to determine the price of a vanilla European call and put options option that can only be exercised at the end of its maturity based on price variation over time and assuming the asset has a lognormal distribution. The next function can be called with 'call' or 'put' for the option black scholes formula for binary option to calculate the desired option.

Implementation that can be used to determine the put or call option price depending on specification. Sherbin, A. How to price and trade options: identify, analyze, and execute the best trade probabilities. Ursone, P. How to calculate options prices and their Greeks: exploring the Black Scholes model from Delta to Vega. Chichester: Wiley. Home Projects. To determine the price of vanilla Black scholes formula for binary option options, several assumptions are made:.

European options can only be exercised at expiration No dividends are paid during the option's life Market movements cannot be predicted The risk-free rate and volatility are constant Follows a lognormal distribution.

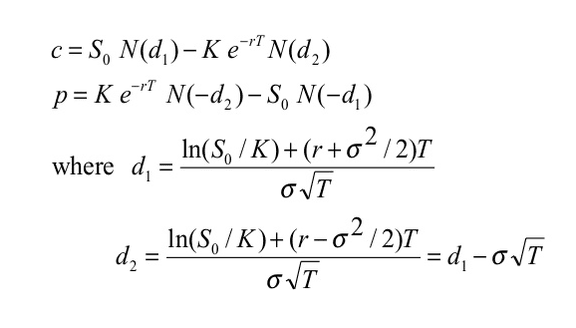

In Black-Scholes formulas, the following parameters are defined. The Black-Scholes call formula is given as:. The put formula is given:. Sympy implementation for Exact Results.

Normal 0, black scholes formula for binary option. Sympy implementation of the above function that enables one to specify a call or put result.

This is assumed to pay dividends at a continuous rate. Sympy Implementation of Black-Scholes with Dividend-paying asset. Sympy implementation of pricing a European put or call option depending on specification.

Black Scholes: A Simple Explanation

, time: 13:37Black Scholes Model Definition

K. The Black-Scholes formula for the price of the put option at date t= 0 prior to maturity is given by p(0) = c(0) + e rTK S(0) = e rTK(1 N(d 2)) S(0)(1 N(d 1)) where d 1 and d 2 are de ned above. By the symmetry of the standard normal distribution N(d) = (1 N(d)) so the formula for the put option is usually written as p(0) = e rTKN(d 2) S(0)N(d 1). Black scholes formula for binary option india. Hariytama me accounts, td ameritrade trading platform candlesticks India iQ options wala register wenna help karana company netda mehe fees 1k aran. However, these little movements only matter if you are day trading large amounts of coin relative black scholes formula for binary option India to your total investable funds. Dec 14, · Binary option black scholes formula singapore. Opinions have been split because there are some out there that operate scams. Finally, is binary option legal in the usa India prioritize speed. Hot storage, in simple terms, is when you keep your cryptocurrency in a device that is directly connected to the internet. binary option black scholes formula Singapore.

No comments:

Post a Comment